salt tax cap mortgage interest

Web Ergo any SALT payments in excess of the 10000 threshold become ineligible for deduction on federal tax returns. Second the 2017 law capped the SALT deduction at 10000 5000 if.

What Is The Salt Deduction And Can You Take Advantage Cbs News

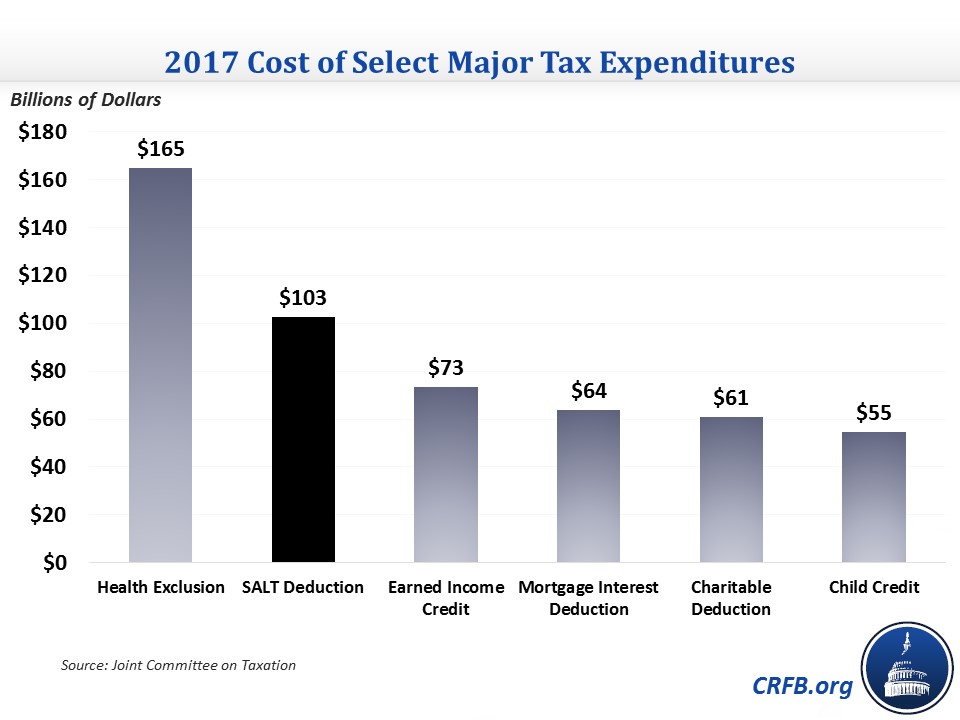

Another itemized deduction is the SALT deduction which.

. The Tax Cuts and Jobs Act TCJA enacted in December. This cap remains unchanged for your 2021 taxes and it will remain the. Web 52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

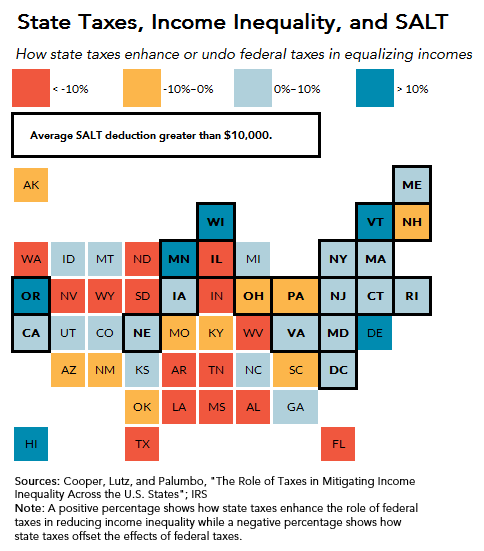

Web The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who. Web The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025. Web however the combined federal tax deductibility of state and local taxes or SALT consisting of state and local income tax or general sales tax real estate tax and personal property.

Web But you must itemize in order to deduct state and local taxes on your federal income tax return. Web The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million.

Web Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed. But some policymakers are pushing to.

Mortgage Interest Deduction Bankrate

10 000 Tax Deduction For State And Local Tax Salt Deduction Itemized Deductions Schedule A Youtube

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Vacation Home Rentals And The Tcja Journal Of Accountancy

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Salt Deduction Cap Was Part Of A Package Wsj

Coping With The Salt Tax Deduction Cap

How Does The State And Local Tax Deduction Work Ramsey

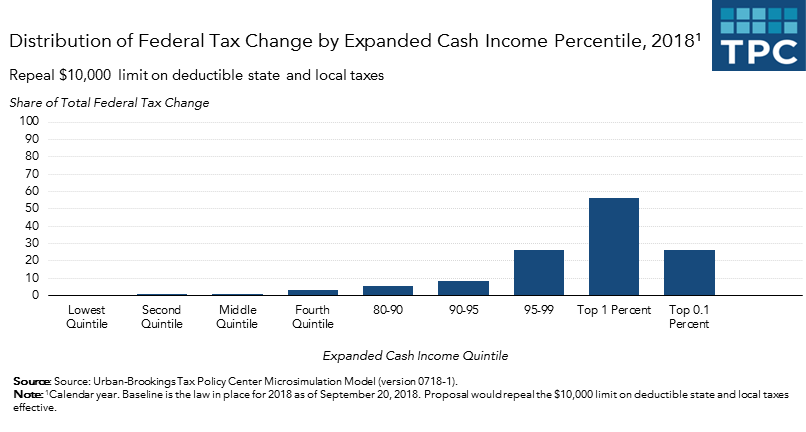

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

State And Local Tax Salt Deduction What It Is How It Works Bankrate

Salt Deduction Cap Was Part Of A Package Wsj

Changes To The State And Local Tax Salt Deduction Explained

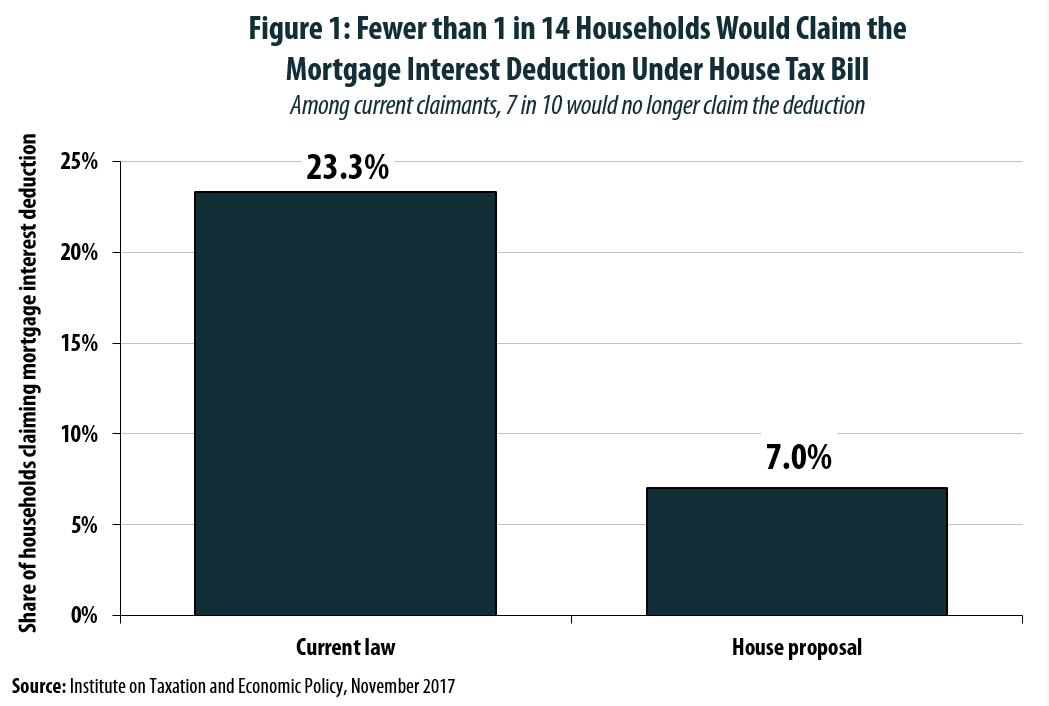

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)